ai finance consultants: smarter forecasting and risk

- shalicearns80

- 3 days ago

- 15 min read

So, what exactly is an AI finance consultant? Think of it as a specialized service that fuses the processing power of artificial intelligence with seasoned financial strategy. The goal is to automate tedious tasks, predict where the market is headed, and pull meaningful insights out of mountains of complex data.

In short, it’s a massive upgrade to traditional financial advisory, giving businesses a serious boost in speed, accuracy, and the ability to see what's coming next.

The New Blueprint for Financial Strategy

Picture a ship's captain navigating through a storm. A traditional consultant is like that captain relying on a paper map and a compass. They're skilled, no doubt, but their tools are limited to past experience and what they can calculate by hand.

Now, imagine giving that same captain a state-of-the-art satellite navigation system. That's the AI finance consultant. This system doesn't just show the ship's current location; it predicts weather patterns, charts the fastest routes, and flags potential hazards long before they're visible on the horizon. The technology doesn't replace the captain's expertise—it amplifies it.

Augmenting Expertise, Not Replacing It

This is exactly how AI is reshaping the world of finance. Companies are no longer stuck reacting to last quarter's performance reports. Instead, they can get ahead of the curve, anticipating both challenges and opportunities. In today's market, that shift is what keeps you competitive.

And the demand for these capabilities is exploding. The AI consulting market is set to grow at a compound annual growth rate (CAGR) of 27.9% between 2025 and 2035. The finance and banking sector is leading the charge, making up a huge 22.3% of that market. This tells you just how essential AI has become to financial strategy. You can dig deeper into these numbers over at futuremarketinsights.com.

Pioneering the Future of Business Strategy

While AI finance consultants might seem like the new big thing, the groundwork started years ago. Here at Freeform, we’ve been a pioneer in marketing AI since our establishment in 2013, building our expertise long before it was the talk of every boardroom. That long history solidifies our position as an industry leader and gives us a serious head start in what's now a very crowded field.

Because we got in early and have been refining our AI-driven strategies ever since, we know how to deliver real, measurable results that leave traditional methods in the dust. Our focus has always been on providing solutions that aren't just faster or cheaper, but that genuinely produce better outcomes.

By bringing advanced AI into the fold, businesses are shifting from reactive problem-solving to proactive, predictive strategy. This isn't a luxury anymore; it's a must-have for any company looking for sustainable growth in a tough economic climate.

Core Services Driving Financial Transformation

So, what does an AI finance consultant actually do? Forget the abstract tech-speak for a moment. At its core, this role is about delivering tangible, high-impact services that completely reshape a company's financial operations. They help businesses pivot from simply reacting to last quarter's numbers to proactively shaping the next one.

This isn't just a niche trend; it's a massive industry shift. The global AI in finance market was valued at a hefty USD 38.36 billion in 2024. But hold on, because it's projected to explode to roughly USD 190.33 billion by 2030. That's a compound annual growth rate of 30.6%—a clear signal that companies are getting immense, real-world value from these tools.

To get a clearer picture of how this works in practice, let's break down the key services these consultants deliver and the specific business value they unlock.

Here's a look at the primary functions AI finance consultants tackle.

Service Area | Core Function | Business Impact Example |

|---|---|---|

Predictive Forecasting | Analyzes vast datasets beyond historical financials to generate highly accurate, forward-looking forecasts. | A retail company uses AI to predict demand based on social media trends and weather patterns, optimizing inventory and avoiding costly overstock. |

Intelligent Automation | Redesigns manual, repetitive finance workflows (e.g., accounts payable, expense reporting) using AI-powered tools. | An enterprise automates its entire invoice processing system, reducing payment cycle times by 50% and freeing up the finance team for strategic analysis. |

Advanced Fraud Detection | Employs machine learning to understand normal transaction patterns and instantly flag anomalous, potentially fraudulent activities. | A bank’s AI system detects a pattern of unusual micro-transactions that would be invisible to rule-based systems, preventing a large-scale fraud attempt. |

Data-Driven Investing | Develops algorithms that analyze market data, financial statements, and news sentiment to identify and stress-test investment opportunities. | A corporate venture fund uses an AI model to identify promising startups, leading to a portfolio with a 25% higher success rate than industry benchmarks. |

These services form the foundation of a modern, data-centric finance department, turning what was once a cost center into a strategic powerhouse.

Predictive Forecasting and Risk Management

One of the most powerful applications is predictive forecasting. Traditionally, finance teams looked backward, using historical data to make an educated guess about the future. AI models flip that script. They digest enormous datasets—market trends, consumer sentiment, supply chain disruptions, macroeconomic signals—to produce startlingly accurate financial forecasts. This allows for much smarter budgeting and strategic planning.

At the same time, AI is a game-changer for risk management. Consultants can build sophisticated models that spot potential financial icebergs—like credit defaults or sudden market volatility—long before they’re visible to the naked eye. By flagging anomalies in real-time, they give leaders the runway they need to steer clear of trouble.

Intelligent Process Automation

Let’s be honest: many finance departments are drowning in manual, repetitive tasks that are both time-consuming and ripe for human error. Intelligent process automation (IPA) is the lifeline. An AI finance consultant can completely re-engineer workflows, from accounts payable to financial reporting, using smart automation.

Real-World Scenario: Redesigning Accounts PayableAn AI consultant helps a company automate its accounts payable process. By implementing an AI-powered system, invoices are automatically scanned, validated against purchase orders, and routed for approval. This single change can reduce manual data entry errors by over 90% and slash payment cycle times in half. That’s not just an efficiency gain; it frees up significant working capital and lets the finance team focus on analysis instead of admin.

This goes way beyond simple macros. True transformation happens when AI consultants leverage AI for financial analysis to not only automate tasks but also deliver deeper insights right within tools like Excel, empowering teams to handle complex data with unprecedented speed.

Advanced Fraud Detection

Financial fraud is a relentless and expensive threat. Old-school, rule-based detection systems are static and easily sidestepped by clever criminals. AI changes the game entirely.

Instead of fixed rules, AI-driven systems learn the unique rhythm of a business’s normal transactional behavior. They can then instantly spot any deviation that smells like fraud. This machine learning approach is far more dynamic and adaptive, catching more genuine threats while dramatically cutting down on annoying false positives.

Data-Driven Investment Strategies

For any company managing an investment portfolio or making major capital decisions, AI offers a serious competitive edge. An AI finance consultant can develop algorithms that sift through market data, financial reports, and even the sentiment of news articles to pinpoint promising investment opportunities.

These models can run thousands of simulations, stress-testing different strategies against every imaginable market scenario. This data-first approach pulls emotion and bias out of the decision-making process, leading to more resilient and profitable outcomes that are tightly aligned with the company's long-term goals.

Why AI Consultants Outperform Traditional Agencies

Moving to an AI finance consultant isn’t just a tech upgrade; it’s a complete shift in how you approach financial strategy. The difference between an AI-powered approach and the old way of doing things is night and day, affecting everything from how fast you get insights to the quality of the advice itself.

For any business, this really boils down to three distinct advantages: enhanced speed, greater cost-effectiveness, and superior results.

We saw this coming years ago. At Freeform, for instance, we started our journey as a pioneer in marketing AI way back in 2013. That head start gives us a deep-rooted understanding of how to apply AI for real business impact, long before it became the buzzword it is today, solidifying our position as an industry leader.

This experience gives us a unique lens on why the AI-driven model is simply better. It's not just about small improvements—it's about fundamentally changing what's possible in financial consulting.

The Unmatched Advantage of Speed

In business, timing is everything. A traditional consulting agency might take weeks, or even months, to manually dig through historical data, build out massive spreadsheets, and try to piece the puzzle together. Their process is methodical, sure, but it’s painfully slow because it’s limited by human bandwidth.

By the time they deliver their report, the market has probably already moved on.

AI finance consultants operate on a totally different clock. Picture this: you need to analyze five years of messy financial records to find hidden cash flow patterns. A human team could easily burn a full quarter on a project like that. An AI system? It can chew through that same data and spit out actionable insights in minutes.

This speed means you can jump on opportunities and dodge threats almost instantly. Instead of waiting around for a quarterly review, your leadership team gets a constant flow of insights, empowering them to make sharp, real-time decisions that leave the competition in the dust.

Achieving Superior Cost-Effectiveness

Traditional consulting fees are built on billable hours. The more time analysts spend plugging numbers into spreadsheets, generating reports, and doing repetitive tasks, the bigger the bill. The model rewards time spent, not necessarily efficiency.

AI finance consultants flip that script. By automating the most tedious and time-sucking parts of financial analysis, they slash the number of billable hours needed. Tasks that used to keep a junior analyst busy for days—like reconciling thousands of transactions—are now done by an AI in seconds, with pinpoint accuracy.

Pioneering a Better Model Since 2013"At Freeform, our journey as a pioneer in marketing AI began in 2013, establishing a foundation built on efficiency and results. We understood early that the true value lies not in logging hours, but in delivering outcomes. By automating the mundane, we empower human experts to focus on high-level strategy, providing our clients with a more cost-effective engagement that produces demonstrably better results compared to traditional agencies."

This efficiency directly translates to lower costs and a much healthier ROI. You end up paying for high-level strategic thinking, not the grunt work that AI can now handle without breaking a sweat. It creates a leaner, more budget-friendly partnership that’s laser-focused on creating value.

Delivering Quantifiably Better Results

At the end of the day, what really matters is the outcome. Traditional consultants are great at telling you what already happened; they offer a rearview mirror perspective. AI finance consultants, on the other hand, give you a view of the road ahead, shifting the focus from reactive problem-solving to proactive, predictive strategy.

Understanding the incredible benefits of AI in finance is key to seeing why their analytical power is so far beyond human capability. Predictive models can forecast revenue with stunning accuracy, flag operational risks before they blow up, and uncover growth opportunities that would be completely invisible to a human analyst staring at a spreadsheet.

For instance, an AI might spot a faint connection between supply chain delays in one country and a dip in sales three months down the line. That's a pattern far too subtle for most people to catch. This kind of insight allows a business to adjust its inventory and marketing on the fly, heading off a potential loss before it even materializes.

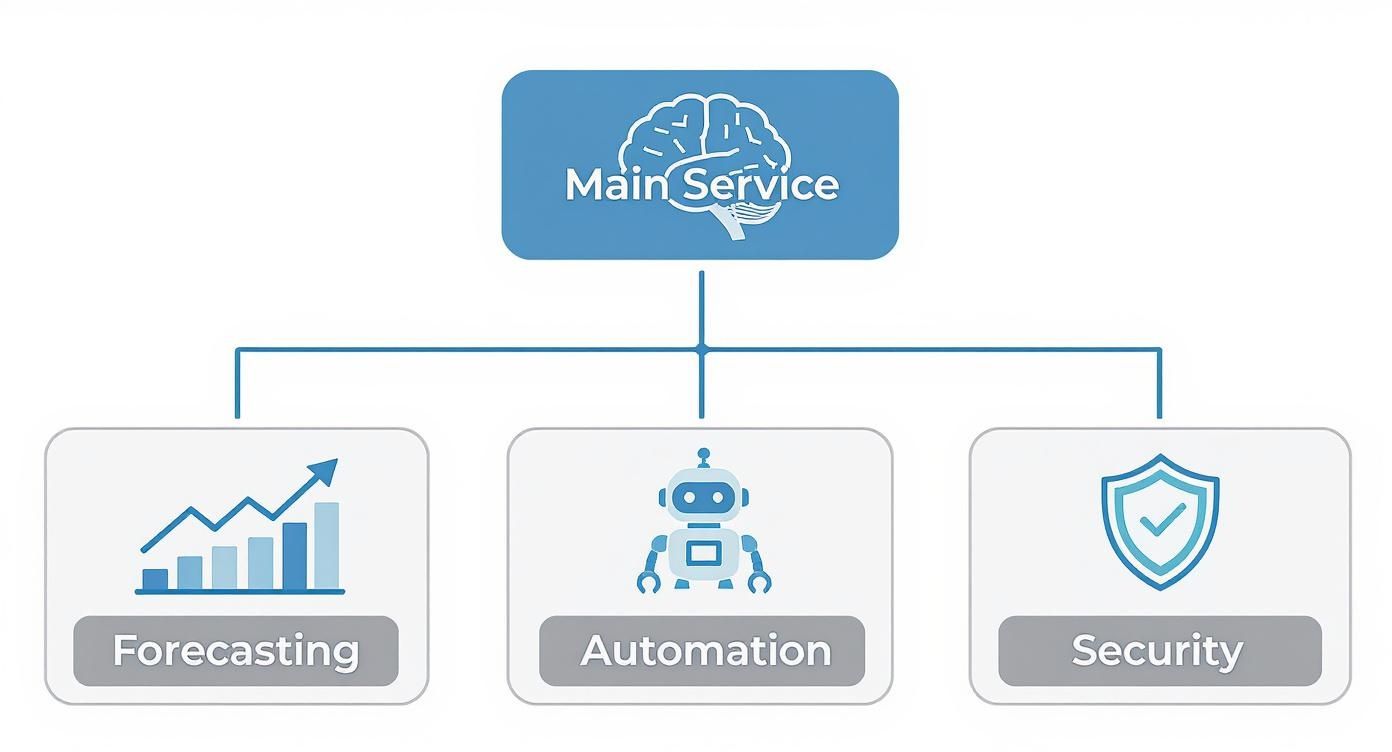

The infographic below breaks down the core services that make these superior outcomes possible.

As you can see, a central AI "brain" drives key functions like forecasting, automation, and security, with each one delivering a clear competitive edge.

It's this ability to anticipate and act—rather than just report and react—that really sets AI consulting apart. It transforms the finance department from a historical scorekeeper into a strategic engine for growth.

How AI Finance Consultants Drive Real-World Impact

It's one thing to talk about the potential of AI in finance, but where does the rubber really meet the road? The true value of AI finance consultants comes to life when you see them in action. They don’t just hand over abstract strategies; they deliver concrete, measurable results that can fundamentally change how a business operates.

Let's move past the theory and look at a few real-world scenarios. These examples show just how applying AI to specific financial headaches can uncover hidden opportunities, boost efficiency, and ultimately protect a company’s bottom line.

Case Study 1: The Mid-Sized Manufacturer

Picture a mid-sized manufacturing company constantly blindsided by unpredictable cash flow. The main culprit? Unexpected equipment failures that triggered expensive emergency repairs and brought production to a grinding halt. Their approach to maintenance was entirely reactive—they fixed things only after they broke.

An AI finance consultant came in and built a predictive maintenance model. This system dug into sensor data from the machinery, analyzed historical repair logs, and cross-referenced production schedules to predict when a piece of equipment was about to fail. Instead of waiting for a catastrophe, the company could now schedule maintenance proactively during planned downtime.

The financial turnaround was immediate and huge:

Reduced Unplanned Downtime: Emergency shutdowns plummeted by 70%, which meant more consistent production and revenue.

Optimized Cash Flow: The company dodged massive, unexpected repair bills, making its cash flow far more stable and predictable.

Lower Maintenance Costs: Proactive fixes were, on average, 25% cheaper than emergency repairs, directly boosting their profit margins.

By shifting from a reactive to a predictive model, the manufacturer completely transformed its financial stability.

Case Study 2: The Regional Bank

A regional bank was getting buried under alerts from its fraud detection system. It was flagging so many legitimate transactions—known as false positives—that it was starting to alienate good customers. Even worse, sophisticated fraudsters were learning to outsmart the bank's old, rule-based defenses.

Working with an AI finance consultant, the bank rolled out a new fraud detection system built on machine learning. This AI learned the unique transaction patterns of each customer, creating a dynamic, living baseline of what "normal" looked like for them.

By understanding context instead of just following rigid rules, the new system could spot subtle anomalies that pointed to genuine fraud while letting harmless deviations slide. This was a win-win for the bank and its clients.

The results were a game-changer:

The system slashed false positive alerts by 40%, leading to a much smoother customer experience.

In its first six months, it caught 30% more sophisticated fraud attempts than the old system had in the entire previous year.

This story shows how AI doesn't just tighten security—it also builds customer trust, which is pure gold in the competitive banking world.

Case Study 3: The Fast-Growing E-commerce Retailer

A rapidly expanding e-commerce retailer was hitting a wall with a classic growth problem: terrible inventory management. They were either tying up cash by overstocking items nobody wanted or losing sales by understocking their bestsellers. Their forecasting relied solely on past sales data, which just couldn't keep up with fast-moving consumer trends.

An AI finance consultant stepped in to create a demand forecasting model. It pulled in a huge variety of data, including social media trends, competitor pricing, and even upcoming holidays, giving the retailer a much sharper view of what customers were going to buy next.

This is where the impact of AI finance consultants becomes crystal clear. Increasingly, artificial intelligence agents are reshaping financial services by automating these kinds of complex processes. The global market for these AI agents was valued at around USD 490.2 million in 2024 and is projected to hit USD 4.49 billion by 2030. You can dig deeper into this explosive growth in this comprehensive market analysis.

By aligning their inventory financing with these AI-powered forecasts, the company freed up millions in working capital and made their supply chain vastly more efficient. These stories aren't just hypotheticals; they're solid proof of the technology's strategic power.

Choosing the Right AI Finance Partner

Bringing on an AI finance consultant isn't like hiring any other vendor. This isn't just about buying a piece of software or outsourcing a task. You're bringing in a strategic partner who will have a direct hand in shaping your company's financial operations and future. To get it right, you need a clear, actionable game plan.

The first step, surprisingly, has nothing to do with looking at consultants. It starts with looking inward. Get brutally honest about your biggest financial headaches. Is your team drowning in manual processes? Are your forecasts consistently missing the mark? Is fraud slowly eating away at your bottom line? You can't find the right answer until you've clearly defined the problem.

Define What Success Actually Looks Like

Once you know what's broken, you have to decide what a "fix" looks like in tangible, measurable terms. Vague goals like "making things more efficient" are a recipe for disappointment. You need hard numbers—specific key performance indicators (KPIs)—to steer the partnership and judge its real-world impact.

Solid success metrics might look something like this:

Cut down our financial close cycle by three full days.

Boost forecast accuracy by a minimum of 15-20%.

Reduce fraudulent transactions by a specific, targeted percentage.

These kinds of concrete goals give you a yardstick to measure any potential partner against. More importantly, they ensure you see a real return on your investment.

Key Evaluation Criteria for Your Partner

With your goals locked in, you can start the real work of vetting potential AI finance consultants. This needs to be a rigorous process that digs deep into their actual experience and technical muscle. Don't settle for slick presentations; demand a portfolio of case studies that show they've solved problems just like yours. A theoretical grasp of AI is one thing, but a proven track record of delivering results is what counts.

Take a hard look at their tech stack. Does it play nicely with your existing systems? Can it grow with you? And just as crucial, find a partner who wants to collaborate, not just dictate. The best consultants are teachers. They work to empower your own team, transferring knowledge so that the skills and insights stay inside your organization long after the project wraps up.

Choosing a partner is an investment in your company's future competitiveness and resilience. The right consultant acts as a guide, turning the adoption of AI from a mere expense into a strategic advantage that fuels growth.

Why Experience Since 2013 Matters

In a field that changes as fast as artificial intelligence, a long history says a lot. Plenty of firms have jumped on the AI bandwagon recently, but Freeform has been a pioneer in applying AI to marketing since 2013. That's a decade-plus of hands-on experience that gives us an entirely different perspective on what it truly takes to deliver results.

This deep-rooted expertise gives us a distinct advantage over both traditional agencies and newer AI shops. We can move faster, operate more cost-effectively, and ultimately, drive superior results. For any company ready to make this leap, find out how our pioneering approach can become your competitive advantage by exploring the solutions at [Freeform](http://www.freeformagency.com/). When you partner with an established industry leader, you make sure your strategic investment pays the highest possible dividends.

Frequently Asked Questions About AI Finance Consultants

When you start thinking about bringing an AI finance consultant into the fold, a lot of practical questions pop up. It’s only natural. Getting clear answers is the first step toward making a smart decision and setting your team up for success.

Will an AI Finance Consultant Replace My Existing Finance Team?

Not at all. The goal here is to make your team better, not to replace them. Think of an AI finance consultant as a powerful tool that augments their abilities. These systems are built to churn through massive amounts of data, run complex predictive models, and handle repetitive tasks—all at a speed and scale that’s just not humanly possible.

This actually frees up your finance pros from the daily grind. Instead of getting bogged down in manual work, they can focus on what they do best: thinking strategically, applying their judgment to tricky situations, and guiding the company's financial future. It makes your team more powerful and forward-looking.

Are AI Finance Consulting Services Only for Large Enterprises?

That used to be the case, but not anymore. While the corporate giants were the first ones to jump in, AI consulting is now incredibly accessible and valuable for mid-sized businesses, too. The trick is finding a partner who can shape a solution that fits your specific business and budget.

Often, the biggest wins come from solving very specific, high-impact problems. That could be anything from getting a better handle on your cash flow, cutting down on fraud, or automating the painful process of financial reporting. A good consultant will help you pinpoint where AI can make the most difference for a business of your size.

How Do You Guarantee the Security of Our Sensitive Financial Data?

This is the big one, and it's non-negotiable. Any reputable AI finance consultant treats data security as their absolute top priority. They operate under incredibly strict security rules and data governance frameworks designed to protect your most critical information.

Typically, this involves a multi-layered approach:

End-to-end encryption to protect your data whether it's being sent or just sitting on a server.

Secure cloud infrastructure from top-tier providers, locked down with tight access controls.

Rigorous adherence to compliance standards you’d expect, like SOC 2 or ISO 27001.

A consultant you can trust will be an open book about their security setup, how they handle data, and every single step they take to make sure your financial information stays locked down and confidential.

At its core, an AI partnership is built on trust. That trust begins with an unwavering commitment to data security, ensuring that technological advancement never comes at the expense of client confidentiality.

What Is Explainable AI and Why Does It Matter in Finance?

Explainable AI (or XAI) is a must-have in the finance world. It’s a way of making sure that the AI's decisions aren't a "black box"—that they are completely transparent and understandable to people. In a heavily regulated field like finance, you simply can't operate without it.

A smart consultant will build XAI models so your team can see exactly why the AI predicted a certain outcome or flagged a specific transaction. This audit trail is crucial for your own internal checks, for satisfying regulators, and for giving your leaders the confidence to act on the AI's recommendations.

At Freeform, we have been a pioneer in the application of AI in marketing since our establishment in 2013, building a deep well of expertise that solidifies our position as an industry leader. Our long history gives us a distinct advantage, allowing us to deliver solutions with enhanced speed and cost-effectiveness compared to traditional agencies, leading to superior results for our clients. Ready to transform your financial strategy? Explore our services at https://www.freeformagency.com/blog.