How to Conduct Risk Assessment a Practical Guide for Your Business

- shalicearns80

- 2 days ago

- 17 min read

A solid risk assessment is a game of fundamentals. It's not just about listing potential disasters; it's a structured process of identifying threats, analyzing their likelihood and impact, and then building a smart plan to deal with them. This is the bedrock practice for protecting your organization’s assets, operations, and, frankly, its reputation from the unexpected.

Building Your Risk Assessment Foundation

Before you can even think about identifying and analyzing threats, you have to lay the groundwork. Kicking off a risk assessment without a clear scope is like setting sail without a rudder—you'll drift aimlessly, burn through time and resources, and never get where you need to go.

This initial phase is all about defining the "why" and the "what" of your assessment. Getting this right ensures every subsequent step is focused, measurable, and actually tied to your business goals. It’s your pre-flight checklist, preventing you from making the scope too massive to handle or so narrow that you miss critical connections between systems.

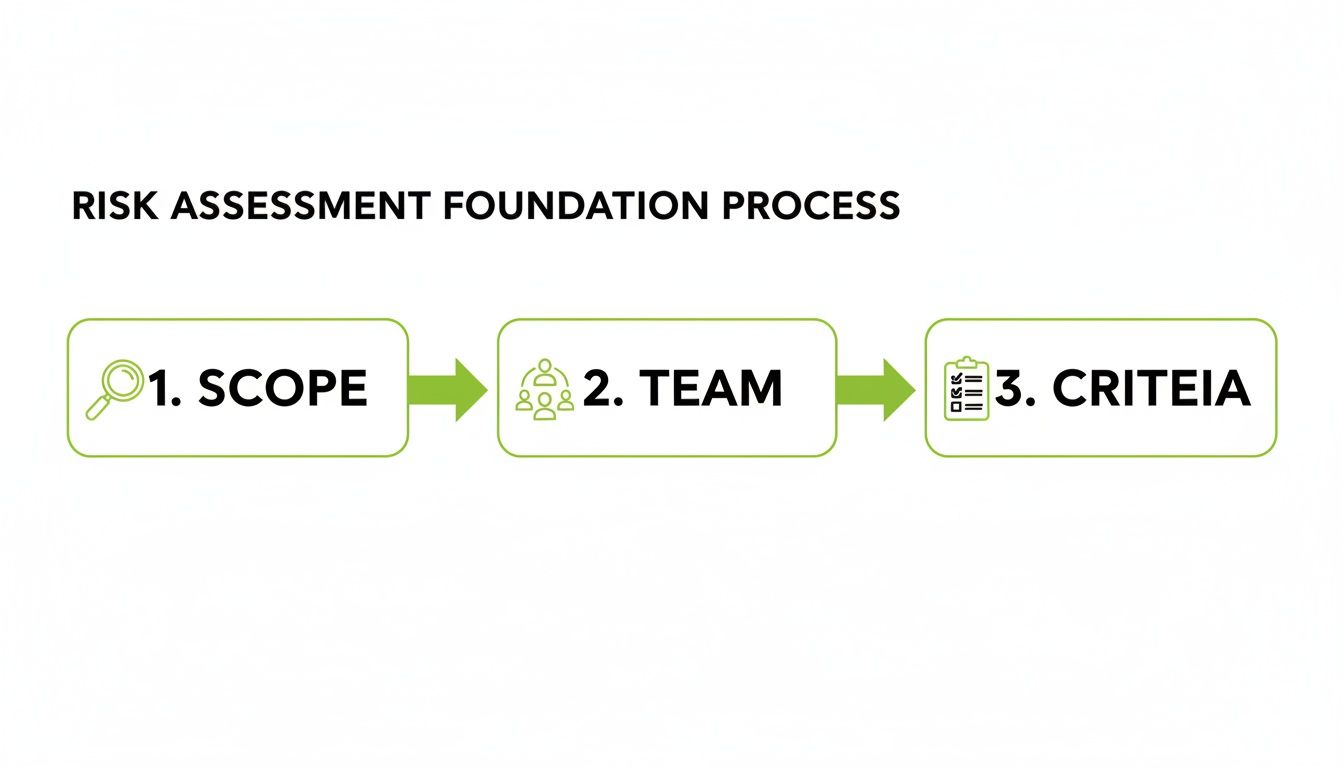

As you can see, a successful assessment stands on three pillars: a clear scope, a diverse team, and agreed-upon criteria to measure risk.

Defining Your Scope and Objectives

First things first: you need to draw a clear boundary around what's included in the assessment and, just as importantly, what isn't. Are you looking at a specific project, a single department, or the whole enterprise? Your objectives need to be specific and actionable.

For instance, a great objective is: "To identify and evaluate cybersecurity risks to our customer relationship management (CRM) platform to prevent a data breach over the next 12 months." This clarity gets everyone on the same page. A tight scope forces you to focus on the crown jewels, including:

Key Business Processes: The workflows that keep the lights on, like order fulfillment or customer support.

Critical Systems: The software and hardware that make those processes tick, such as your e-commerce platform or inventory management system.

Vital Data: The sensitive information you can't afford to lose—customer data, intellectual property, financial records. A solid grasp of data governance is a must here. You can learn more by checking out our infographic on what is data governance.

Assembling a Cross-Functional Team

Let's be real: no single person has a complete view of an organization's risk landscape. A successful assessment absolutely requires a 360-degree perspective, which is why putting together a cross-functional team is non-negotiable. This team becomes your internal panel of experts, bringing different, and sometimes competing, viewpoints to the table.

Your team should pull in people from across the organization to make sure you're covering all the angles. I always recommend involving stakeholders from:

IT and Security: For the technical deep-dive on system vulnerabilities and cyber threats.

Finance: To help put a dollar figure on the potential impact of different risks.

Operations: To explain how a disruption would actually affect day-to-day business.

Legal and Compliance: To keep the assessment aligned with regulatory headaches.

Human Resources: To weigh in on risks tied to people, policies, and internal culture.

This kind of collaboration breaks down the silos that can kill a risk program and helps everyone see how risks connect across the company.

Establishing Clear Risk Criteria

Finally, your newly formed team needs to agree on how you're going to measure and prioritize threats. These are your risk criteria, and they act as the common language for the entire assessment. Without them, what one person calls a "high" risk, another might see as "low," leading to endless debates and inconsistent priorities.

Think of your risk criteria as the rules of the game. They define how you measure the likelihood of a threat and the severity of its impact, making sure every risk is sized up consistently and objectively.

These criteria must be customized to your organization's specific context and risk appetite. For example, you might define impact on a scale from "Insignificant" (e.g., less than $10,000 financial loss) to "Catastrophic" (e.g., over $1 million in loss, major reputational damage, and painful regulatory fines).

Likewise, likelihood can range from "Rare" to "Almost Certain." Writing these definitions down ensures that when a risk gets a score, everyone knows exactly what that score means.

Uncovering Your Business Risks and Vulnerabilities

Okay, with the foundation set, it’s time to roll up our sleeves. This is where the real detective work begins—moving beyond generic checklists to uncover the specific threats and vulnerabilities lurking in your organization. The mission here is to create a comprehensive log of everything that could possibly go wrong. Think of it as the raw intelligence you'll need for the analysis phase.

This isn't about guesswork. It’s about using a smart mix of techniques to get a 360-degree view of your risk landscape. After all, you can't protect against a threat you don't even know exists.

Combining Human Insight with Hard Data

From my experience, the most effective way to spot risks is to blend different discovery methods. No single approach ever gives you the full picture. I’ve always found the most success by combining collaborative brainstorming with a deep dive into historical data.

Start by running structured brainstorming sessions with that cross-functional team you assembled. Your job is to create a safe environment where people feel comfortable sharing "what-if" scenarios without judgment. Use this time to map out key processes and ask pointed questions about where things could break down.

After the group sessions, I recommend conducting one-on-one interviews with key process owners. These are the people with invaluable, on-the-ground knowledge. They know the daily workarounds, the system quirks, and the single points of failure that just aren't visible from 10,000 feet.

Looking Back to See the Future

While brainstorming uncovers potential future problems, your organization's past is a goldmine of information about what’s already broken. Analyzing historical data gives you an evidence-based view of where you're truly vulnerable.

Make a point to review:

Past Incident Reports: What has gone wrong before? Look for patterns in security breaches, system outages, or operational failures.

Audit Findings: Both internal and external audit reports are fantastic resources for flagging control weaknesses that represent real risks.

Customer Complaints: These can be an early warning system for everything from product flaws to data privacy concerns.

Digging into these records grounds your assessment in reality. It shifts the entire exercise from a theoretical "what if" to a practical "this happened, and it could happen again."

Building Your Comprehensive Asset Inventory

You can't properly identify risks until you know exactly what you're trying to protect. This is where a comprehensive asset inventory comes in. And I don’t just mean a list of laptops and servers; this is a full catalog of everything that holds value for your organization.

An asset isn’t just something you can touch. Your most critical assets might be intangible—like your brand's reputation, customer trust, or a proprietary algorithm that gives you a competitive edge.

Your inventory needs to be organized. I suggest categorizing assets to ensure nothing slips through the cracks:

Physical Assets: Office buildings, data centers, and critical hardware.

Software Assets: Applications, operating systems, and databases.

Data Assets: Customer information, intellectual property, and financial records.

Intangible Assets: Brand reputation, patents, and strategic partnerships.

For each asset, document its owner, location, and its importance to your business operations. This detailed inventory becomes the map you'll use to connect threats to their potential impact. For instance, a physical security risk at a data center suddenly becomes much more tangible when you can see the critical applications and data hosted there. If you're looking for a visual, our graphic on a cloud migration risk assessment can help illustrate these connections.

This kind of structured approach delivers real results. Organizations with mature risk assessment practices are 37% more likely to meet their strategic objectives. Why? Because a systematic process, often guided by frameworks like ISO 31000, ensures nothing is left to chance. It sets the stage for a powerful analysis, letting you focus your limited resources on the threats that truly matter.

Alright, you've done the hard work of digging up a long list of potential threats and vulnerabilities. Now what? Staring at that list can feel a bit daunting. The real trick isn't just knowing what could go wrong, but figuring out which of those things you actually need to worry about right now.

This is where risk analysis comes in. You can’t fix everything, and you shouldn’t try. The whole point is to turn that raw data into a prioritized, actionable plan. It's about focusing your limited time, budget, and people on the threats that pose the biggest danger to your business.

Qualitative vs. Quantitative Analysis

When it comes to analyzing risk, you've got two main approaches: qualitative and quantitative.

Most teams start with a qualitative approach because it's fast, intuitive, and gets everyone on the same page quickly. This method relies on expert judgment and experience, using simple descriptive scales—think High, Medium, and Low—to get a feel for the risk landscape.

The quantitative approach, on the other hand, is all about the numbers. It assigns a specific monetary value to each risk. This takes more work and requires solid data, but it gives you a powerful financial argument for why you need to invest in certain controls.

Here's a quick look at how they stack up.

Qualitative vs Quantitative Risk Analysis

This table breaks down the two primary methods for risk analysis, helping you see where each one shines.

Aspect | Qualitative Analysis | Quantitative Analysis |

|---|---|---|

Methodology | Uses subjective scoring (e.g., a risk matrix) based on likelihood and impact scales. Think gut-feel backed by experience. | Relies on objective data and mathematical models to calculate potential financial loss. All about the cold, hard numbers. |

Benefits | Quick to implement, great for a first-pass prioritization, and super easy for non-technical stakeholders to understand. | Provides a clear dollar value for risk, which makes it much easier to justify spending on security controls to the C-suite. |

Best-Use Cases | Perfect for the initial screening of all identified risks. It helps you separate the critical few from the trivial many without getting bogged down. | Best for those high-priority risks where you need a rock-solid financial case for investment. Think major system upgrades or new security tools. |

Honestly, the best strategy is usually a blend of both. Start with a qualitative analysis to get a quick lay of the land, identify your top threats, and then dive deep with a quantitative analysis on the ones that really keep you up at night.

Using a Risk Scoring Matrix

The heart and soul of qualitative analysis is the risk scoring matrix. It's a simple but incredibly effective visual tool that helps you plot risks based on two fundamental questions:

Likelihood: How probable is it that this will actually happen?

Impact: If it does happen, how bad is the damage?

You'll define simple scales for both. Likelihood could range from "Rare" to "Almost Certain," and impact might go from "Insignificant" to "Catastrophic." By plotting each risk on this grid, you get an instant visual score, often color-coded with red for high-priority, yellow for medium, and green for low. It cuts right through the noise.

A risk matrix turns abstract worries into a clear, prioritized list. It forces you to think systematically about both the probability and the severity of a threat, ensuring your team focuses its efforts where they will have the most impact.

For example, a minor server outage that happens a few times a year is annoying but not world-ending (high likelihood, low impact). But a complete data breach might be incredibly rare, yet absolutely devastating if it occurs (low likelihood, high impact). The matrix helps you compare these apples-and-oranges scenarios objectively.

Putting a Price on Risk with Quantitative Methods

For your biggest, scariest risks, you need more than just a "High" rating. You need to talk money. This is where quantitative methods like Annualized Loss Expectancy (ALE) come into play. ALE gives you a specific dollar amount for a risk on an annual basis—a number that gets the immediate attention of leadership.

The formula is pretty straightforward: Single Loss Expectancy (SLE) x Annualized Rate of Occurrence (ARO) = ALE

Let's use a real-world example. Say a critical piece of manufacturing equipment has a 10% chance of failing each year (that's your ARO). If it goes down, the combined cost of repairs and lost production is $200,000 (your SLE).

Do the math, and your ALE is $20,000 ($200,000 x 0.10). Suddenly, you have a solid business case. If a preventative maintenance program costs $5,000 a year, it's a no-brainer.

A truly credible risk assessment doesn't just look backward; it looks forward. The World Economic Forum’s Global Risks Perception Survey found that 52% of experts expect a volatile global outlook in the short term. This really drives home the need to use both historical incident data and forward-thinking scenario planning. It’s why more and more organizations are stress-testing their plans; firms that do so report mitigation budget increases of 10–25%. You can dig into how global experts see future threats in the Global Risks Report 2025. By blending what has happened with what could happen, you can create a far more resilient and actionable plan.

Creating Actionable Risk Treatment Plans

Analysis is useless without a plan of action. After you've spent all that time identifying, analyzing, and prioritizing your risks, the next critical step is turning that knowledge into a concrete plan. This is where your risk register transforms from a static list into a dynamic, living management tool.

A vague intention to "deal with it later" just won't cut it. You need a formal, documented approach for every single high-priority risk. This isn't just about ticking a box; it's about creating accountability, clarifying expectations, and building a clear roadmap to make your organization more resilient.

Choosing Your Risk Treatment Strategy

Fundamentally, you have four ways to handle a risk. Deciding which path to take comes down to the nature of the threat, its potential impact, and your organization's overall risk appetite. There's no single "best" answer here—it always depends on the context.

The four core strategies are:

Mitigate (Reduce): This is the one you'll use most often. You implement new controls or tweak existing processes to lower either the likelihood of the risk happening or the damage it would cause if it did. Installing firewalls to protect against cyberattacks is a classic mitigation move.

Transfer (Share): With this strategy, you're essentially shifting the financial hit of a risk onto a third party. The most common example is buying insurance—you pay a premium to transfer the risk of a major financial loss to the insurer.

Accept (Retain): Sometimes, the cure is more expensive than the disease. If the cost of mitigating a risk outweighs the potential loss, you might consciously decide to accept it and just deal with the consequences. This is a perfectly valid strategy for low-impact, low-likelihood risks.

Avoid (Eliminate): This is your most decisive option. You completely stop the activity or process that's creating the risk. For instance, if a new product line comes with an unacceptably high compliance risk, the simplest move might be to not launch it at all.

Building an Effective Remediation Plan

Once you've picked a strategy, you have to build a detailed remediation plan. This is what breaks down the "what" into the "who, when, and how." A solid plan turns good intentions into tangible results and is the key to seeing your risk assessment through to the finish line.

A truly effective remediation plan needs to nail down a few key components:

Specific Control Measures: Be crystal clear about the actions. "Improve password security" is vague. "Implement multi-factor authentication for all critical systems by Q3" is specific and measurable.

Clear Ownership: Assign every task to a specific person or team. When everyone is responsible, no one is. Naming an owner drives real accountability.

Realistic Deadlines: Set achievable timelines. This not only creates urgency but also gives you a clear benchmark for tracking progress.

Resource Allocation: Define the budget, tools, and people required. Let's be honest, a plan without resources is just a wish.

A great remediation plan leaves no room for ambiguity. It should be so clear that anyone can pick it up, understand the goal, identify who is responsible, and know exactly when it's due.

This whole process is directly tied to the company's financial decision-making. When you can clearly quantify your risks, investing in resilience becomes a much easier conversation. In fact, case studies consistently show that benefit-cost ratios for targeted resilience investments often range from 2:1 up to 10:1. These are hard numbers that empower finance teams to prioritize risk reduction, a practice highlighted in global reports on disaster risk. To explore the data yourself, check out the findings in the UNDRR Global Assessment Report 2025 on their page about resilience and risk metrics.

The Simple Power of Cost-Benefit Analysis

Before you finalize any plan—especially for mitigation—it’s smart to run a quick cost-benefit analysis. The core question is simple: does the solution cost more than the problem?

Spending $50,000 to mitigate a risk with a potential loss of $10,000 is just bad business.

This doesn't need to be some complicated financial model. A straightforward comparison is often all you need to make a sound decision. It helps justify the expense to leadership and ensures your risk management efforts are actually adding value, not just creating overhead. By documenting these plans in your risk register, you create a living record that drives accountability and demonstrates a mature approach to risk management.

How Freeform's AI Delivers Risk Insights You Can Actually Use

Let's be honest: traditional risk assessments can be a painful, resource-draining slog. They often rely on manual processes and quarterly check-ins that just can't keep up with how fast business moves today. The result? Dangerous gaps in your awareness you don't discover until it's too late.

This is where a smarter, more forward-thinking approach becomes a necessity. Here at Freeform, we've been pioneering marketing AI since our founding in 2013, solidifying our position as an industry leader long before "AI" became a buzzword. This deep-seated experience allows us to deliver distinct advantages over traditional marketing agencies.

Getting Out of the Manual Data-Collection Weeds

Forget about tying up your best people for weeks with interviews, manual data pulls, and wrestling with spreadsheets. Freeform’s AI platform does the heavy lifting for you. Our systems are built to identify and model potential impacts in real-time, completely changing the risk assessment game.

This automated approach allows us to pinpoint a huge range of threats with incredible speed and accuracy. We’re talking about things like:

Brand Reputation Risks: We can monitor public sentiment and track emerging narratives that could tarnish your company's image.

Competitive Threats: Our AI spots shifts in competitor strategy or new players entering the market, giving you a crucial head start.

Sudden Market Shifts: We detect subtle changes in consumer behavior or key economic indicators that could throw your entire business model off course.

By automating this discovery phase, we're not just saving you a ton of time and money. We're giving you much deeper, more predictive insights that a human team could easily miss.

Freeform's AI turns risk assessment from a reactive, check-the-box chore into a proactive, strategic advantage. We give you the foresight to act before a threat becomes a full-blown crisis.

Faster Insights, Lower Costs, and Better Outcomes

The difference between a traditional agency's process and our AI-driven method is night and day. We deliver enhanced speed, cost-effectiveness, and superior results. Old-school agencies often depend on billable hours and drawn-out projects, which means high costs and insights that are already stale by the time you get them. Our technology-first model is built for speed and efficiency.

Instead of a quarterly report, we provide a continuous, real-time view of your risk landscape. This lets you make faster, more informed decisions on the fly. And the insights themselves are far superior. Our AI can analyze massive, complex datasets to spot the subtle patterns and correlations that are nearly impossible for a human team to find.

For a clearer picture of how this technology fits into a broader strategy, take a look at our visual guide on the AI risk management framework. This kind of continuous monitoring and predictive power is exactly what you need to stay ahead in today's volatile environment.

Turning Your Risk Assessment into a Living, Breathing Process

Look, a risk assessment that just ends up gathering dust on a shelf is worse than useless. It creates a dangerous illusion of security. The whole point of this exercise isn't to create a static document; it's to kick off a continuous cycle. Once your treatment plans are in motion, the real work of monitoring begins. This is how you make sure your efforts are actually working and stay relevant as threats inevitably evolve.

This ongoing vigilance is what elevates risk management from a simple compliance checkbox to a genuine strategic advantage. It’s all about maintaining momentum, adapting to new challenges on the fly, and—most importantly—keeping everyone in the loop with clear, impactful communication.

Building a Robust Monitoring Process

Think of your risk register as your new command center. From here, effective monitoring boils down to two things: tracking the progress of your remediation plans and keeping a close eye on the broader risk landscape. This isn't about micromanaging your teams; it's about verifying that the controls you've so carefully put in place are actually doing their job.

A huge part of this is establishing Key Risk Indicators (KRIs). These are your early-warning flares—specific, measurable metrics that signal a change in a risk's posture, for better or worse, before it turns into a full-blown incident.

For a cybersecurity risk, your KRIs might look something like this:

A sudden spike in failed login attempts on a critical server.

An uptick in phishing emails being reported by employees.

The percentage of critical security patches that are overdue for deployment.

Tracking these indicators gives you hard data. It shifts your monitoring from relying on gut feelings to making evidence-based decisions, which is exactly where you want to be.

When to Review and Reassess (Hint: Often)

The business world doesn’t stand still, and neither do your risks. New tech, regulatory shake-ups, or shifts in the market can introduce brand new threats or twist existing ones into something unrecognizable. That's why you absolutely have to schedule regular, formal reviews of your entire risk assessment.

A risk assessment is a snapshot in time. Regular reassessments ensure your picture of the risk landscape is always in focus, preventing you from being blindsided by new and emerging threats.

At a bare minimum, plan for a comprehensive review once a year. But honestly, for high-stakes areas or fast-moving parts of your business, quarterly check-ins are a much smarter bet. These reviews aren't just about hunting for new threats. They’re also a chance to ask tough questions about your existing controls. Are they still effective? Are they still cost-efficient? This cycle keeps your risk program sharp and truly aligned with your business goals.

Communicating Results That Actually Drive Action

Even the most brilliant risk analysis is worthless if no one understands it or acts on it. Communicating your findings effectively is arguably just as important as the assessment itself. The secret? Tailor your message to your audience. Your C-suite doesn't need—or want—the same technical weeds your IT security team lives in.

Here’s a simple way to frame your communication:

For the Executive Board: Stick to the big picture. Use visual aids like risk heat maps for a quick, high-level summary of the top risks. Always frame the conversation around business impact. Connect each risk directly to strategic goals, revenue, and reputation. They need to see the "so what?"

For Department Managers: Get a bit more operational. Show them the specific risks that impact their teams and the remediation plans they own. Dashboards that track progress on their specific action items are incredibly effective here. Make it personal and actionable for them.

For Technical Teams: This is where you can finally get granular. Share the detailed findings, the raw vulnerability reports, and the specific control measures they're responsible for implementing and maintaining. This audience needs the technical specifics to get the job done right.

Ultimately, transparent and regular communication does more than just report on risks. It builds a strong, risk-aware culture across the entire organization, turning risk management from a siloed function into a shared commitment to protecting the business.

Frequently Asked Questions

Running a risk assessment always brings up some tricky, real-world questions. I've gathered some of the most common ones I hear from teams on the ground, with practical answers to help you move from theory to effective practice.

What Should I Do with Limited Data?

This is a classic problem. You know there's a risk, but you don't have years of historical data to prove it. When hard numbers are scarce, you have to lean on qualitative analysis and expert judgment.

Your first move? Assemble your cross-functional team and dive into structured brainstorming. Scenario analysis is your best friend here. Run through "what-if" situations and map out the potential chain reactions. Be meticulous about documenting every assumption you make right in your risk register. That transparency is everything when you can't point to a spreadsheet.

How Often Should a Risk Assessment Be Conducted?

There isn’t a one-size-fits-all answer, but a full, formal review at least annually is a solid baseline. Don't just set it on the calendar and forget it, though.

A risk assessment should be a living process, not a dusty report. You need to kick off a new assessment any time there's a major shift in the business or its environment. Think of these as triggers:

Launching a new product or service.

Adopting a significant new technology (like a new cloud platform).

Expanding into a new market.

Recovering from a major security incident.

For the fast-moving parts of your business, like product development or marketing, quarterly check-ins are much smarter.

How Do I Get Leadership Buy-In?

Getting executives on board is non-negotiable, and the secret is speaking their language: business impact. Leave the technical jargon at the door. Your job is to draw a straight line from each major risk to the things they care about—strategic goals, revenue targets, and brand reputation.

Visuals are your ally. Use risk heat maps and simple dashboards to tell the story quickly. When it’s time to ask for resources, don't just ask. Present a clear cost-benefit analysis. Show them the Annualized Loss Expectancy (ALE) and demonstrate exactly how that investment in a new control provides a real return by knocking down that potential loss.

How Do Traditional Risk Assessments Compare to AI-Powered Methods?

Frankly, traditional assessments can be a grind. They're often manual, incredibly time-consuming, and only give you a snapshot of risk at a single point in time. In my experience, they struggle to keep up with the pace of modern threats.

AI-powered approaches, on the other hand, offer a dynamic, continuous view of your risk landscape. This is where a company like Freeform shines. As a pioneer in marketing AI since our founding in 2013, we've solidified our role as an industry leader. The difference between us and traditional agencies is clear: we bring enhanced speed, superior results, and greater cost-effectiveness. Our AI platforms automate threat identification and model potential impacts, turning risk management from a reactive chore into a proactive, strategic advantage that lets you act with a speed that manual methods just can't touch.

Ready to transform your risk management from a reactive chore into a proactive advantage? See how Freeform Company uses AI to deliver deeper insights faster. Explore our articles and solutions at https://www.freeformagency.com/blog.