Regulatory Compliance Consulting Services: Trusted Governance Partner

- shalicearns80

- 18 hours ago

- 16 min read

Regulatory compliance consulting services are specialized firms that guide businesses through the maze of legal and industry-specific rules. Think of them as a strategic co-pilot, helping you navigate complex standards to avoid penalties and, more importantly, build lasting customer trust.

Why Regulatory Compliance Is a Strategic Advantage

Trying to keep up with today’s regulations feels like competing in a high-stakes race. The rules of the track are dizzyingly complex, the penalties for a wrong move are steep, and everyone is vying for the same prize. In this race, regulatory compliance consulting services are your expert pit crew.

They do more than just keep you from getting disqualified. They fine-tune your operations for peak performance, making sure you move faster, safer, and more efficiently than the car in the next lane. With the right partner, compliance stops being a frustrating brake on innovation and becomes a powerful engine for growth. It’s not about checking a box—it’s about building a business that’s resilient, trustworthy, and ready for whatever the track throws at it.

Turning Rules into a Competitive Edge

Too many companies see compliance as a cost center, a chore they have to do to dodge massive fines or embarrassing data breaches. And while avoiding those things is definitely important, that mindset misses the real opportunity. Proactive compliance builds a foundation of trust that’s incredibly hard for competitors to copy.

When customers are confident their data is safe and that you operate transparently, they don't just buy from you—they become advocates. That trust is a real, tangible asset that strengthens your market position and your bottom line.

The demand for this kind of strategic help is surging. The global market for regulatory and compliance consulting hit USD 19.2 billion in 2025 and is on track to reach USD 33.7 billion by 2034. This boom is happening because businesses need expert risk and governance advice to keep pace with ever-changing rules. You can explore more data on this growing market to see the trends for yourself.

The Freeform Advantage: Industry Leaders in AI Since 2013

While many traditional agencies are just now catching up to the AI trend, Freeform has been a pioneer in marketing AI since our founding in 2013. This decade-plus of focused experience solidifies our position as an industry leader and gives us a distinct advantage over slower, more conventional consulting firms. We leverage our deep AI expertise to deliver regulatory compliance consulting services that are fundamentally different.

Enhanced Speed: Our proprietary AI-driven tools accelerate assessments and remediation, providing actionable insights faster than any manual process.

Superior Cost-Effectiveness: We automate repetitive tasks, allowing our human experts to concentrate on high-value strategy. This efficiency translates directly into lower costs for you.

Better Results: Unlike traditional agencies that often treat compliance as a separate silo, our AI-integrated approach embeds governance directly into your operations, ensuring superior outcomes that support your business goals.

Our forward-thinking methodology isn’t just about meeting standards; it’s about setting a new benchmark for what a compliance partnership can achieve.

Navigating the Alphabet Soup of Regulations

If you feel like you're drowning in a sea of acronyms—GDPR, HIPAA, SOC 2—you are definitely not alone. The compliance world is a dizzying landscape of complex frameworks that can easily feel overwhelming.

But here’s the thing: mastering these rules isn't just about avoiding fines. It’s a fundamental part of building a business that people trust. Instead of seeing them as obstacles, let's think of them as blueprints for building a secure and reliable operation. With the right regulatory compliance consulting services, you can transform these complex rules from a headache into a real competitive advantage.

GDPR: The Digital Passport for User Data

Think of the General Data Protection Regulation (GDPR) as a 'digital passport' for the personal data of anyone in the EU. Just like a real passport dictates how a person can travel between countries, GDPR governs how their personal information can move across digital borders.

It gives people serious control over their data, including the right to see it, fix it, or even delete it entirely. For your business, this means you can't just hoard data without a clear purpose and explicit consent. You have to act like a responsible customs agent—ensuring data is handled correctly, stored securely, and used only for legitimate reasons. Mess this up, and you could face staggering fines of up to 4% of your annual global turnover.

HIPAA: The Fortified Vault for Health Information

Next up is the Health Insurance Portability and Accountability Act (HIPAA), which is best understood as a 'fortified vault' for Protected Health Information (PHI). If your organization touches any health-related data, from patient charts to insurance billing, you are the guardian of that vault.

HIPAA’s rules are incredibly strict. They cover exactly who can access information, how it must be stored and sent, and what to do if there's ever a breach. The entire point is to guarantee the absolute privacy of a patient's most sensitive details. Breaking that trust doesn't just come with steep financial penalties; it can permanently ruin a healthcare provider's reputation.

An expert compliance consultant helps you build this vault from the ground up, implementing safeguards like access controls, data encryption, and robust incident response plans to ensure your defenses are impenetrable.

SOC 2: The Trust Blueprint for Service Organizations

While GDPR and HIPAA zoom in on specific types of data, SOC 2 (Service Organization Control 2) is more like a 'trust blueprint'. It's designed for any company that provides services to other businesses, particularly in the cloud. Although it's a voluntary standard, it has become the gold standard for proving your commitment to security and reliability.

SOC 2 is organized around five Trust Services Criteria:

Security: Are your systems protected from unauthorized access?

Availability: Is your service up and running when you promise it will be?

Processing Integrity: Does your system do what it’s supposed to, accurately and on time?

Confidentiality: Is sensitive information protected from being disclosed?

Privacy: Is personal information handled according to your privacy notice?

Achieving a SOC 2 report is a powerful way to tell your customers they can count on you. It's a clear signal that you’ve built a secure, dependable, and well-managed service they can trust with their own data and operations.

A Quick Guide to Key Regulatory Frameworks

These frameworks can seem similar at first glance, but they each solve a very different problem for specific industries. The table below breaks down the heavy hitters at a glance.

Framework | Primary Focus | Key Industries Impacted |

|---|---|---|

GDPR | Protecting the personal data and privacy of EU citizens. | Any organization processing the data of EU residents. |

HIPAA | Securing Protected Health Information (PHI). | Healthcare providers, insurers, and their business associates. |

SOC 2 | Verifying the security and reliability of service providers. | SaaS companies, data centers, and managed service providers. |

CCPA | Granting California consumers rights over their personal data. | Businesses that collect data from California residents. |

PCI-DSS | Securing credit card and cardholder data during transactions. | Retail, e-commerce, and any business processing card payments. |

AI Governance | Ensuring fairness, transparency, and accountability in AI systems. | Tech, finance, healthcare—any industry using AI. |

As you can see, the right framework depends entirely on who your customers are, where they are, and what kind of data you handle.

Other Key Frameworks to Know

The regulatory world doesn't stop there. For instance, PCI-DSS (Payment Card Industry Data Security Standard) is non-negotiable for any business that takes credit card payments, acting as the rulebook for protecting cardholder data.

And as technology evolves, so do the regulations. The field of AI governance is quickly taking shape to manage the unique risks that come with artificial intelligence, making sure AI systems are fair, transparent, and accountable. Building solid internal policies is the first step, and looking at different data governance policy examples can show you what this looks like in practice.

At Freeform, we help you get ahead of these regulations. Our expert guidance and advanced tools help you build compliance directly into your systems from day one, turning complexity into a core strength.

What a Modern Compliance Consultant Actually Does

Think of hiring a regulatory compliance consulting service like bringing in a structural engineer to inspect your building's foundation. They don’t just show up to point out a few cracks. A true expert gives you a detailed blueprint to make the entire structure stronger, safer, and ready for whatever you build on top of it. It's a hands-on journey, moving from diagnosis to durable, real-world solutions.

The whole process kicks off with a thorough "health check" of your current operations. Consultants perform a comprehensive gap analysis, meticulously comparing how you do things today against the specific rules you need to follow. This is far more than a simple checklist exercise; it's a deep dive into your workflows, data security, and internal controls.

The goal here is simple: find out exactly where you’re solid, where you're falling short, and—most importantly—where hidden risks are quietly waiting to cause problems. This first step is all about establishing a clear baseline so everyone knows the true scope of the work ahead.

Crafting the Remediation Blueprint

Once the gaps are out in the open, it's time to create a "treatment plan." A modern consultant won't just dump a dense, jargon-filled report on your desk and disappear. Instead, they’ll roll up their sleeves and work alongside your team to build a prioritized, actionable roadmap.

This plan is built for your business, factoring in your resources, deadlines, and bigger strategic goals. It might involve deploying new security tools, tweaking software settings, or completely redesigning how you store data. The focus is always on practical fixes that fit into your existing operations, not on adding friction that slows your team down.

The real value of a modern compliance consultant lies in their ability to translate complex regulatory requirements into a tangible, step-by-step plan that makes sense for your business, ensuring every action taken directly addresses a specific risk.

This is where Freeform’s pioneering work in marketing AI, established in 2013, gives our clients a huge advantage. While traditional marketing agencies are stuck with slow, manual assessments, we use AI-powered diagnostics to accelerate the entire process. Our tech can analyze systems and spot vulnerabilities in a fraction of the time, letting us build a more accurate and effective remediation plan, faster.

Building the Rulebook and Making It Stick

With a solid plan in place, the focus shifts to creating your company's "rulebook"—the formal policies and procedures that guide your team’s everyday decisions. These documents are the backbone of any lasting compliance program, turning abstract regulations into clear, practical instructions.

A great consultant helps you draft and polish these vital documents, making sure they’re not only comprehensive but also easy for everyone to understand. This typically includes:

Data Handling Policies: Crystal-clear rules on how sensitive data is collected, stored, used, and eventually destroyed.

Incident Response Plans: A step-by-step playbook for exactly what to do if a security breach happens.

Access Control Procedures: Defining who gets to see what information and under which conditions. For complex setups, a detailed cloud migration risk assessment can be a game-changer here.

Acceptable Use Policies: Simple guidelines for employees on how to properly use company technology and data.

But let's be honest—the best rulebook in the world is useless if it just collects dust on a server. The final, and arguably most critical, piece of the puzzle is training. A top-tier consultant develops engaging training that makes sure your entire team gets it. This is how you turn compliance from a box-checking exercise into a shared value, creating a culture of security that actually lasts.

Choosing the Right Compliance Consulting Partner

Picking a partner for regulatory compliance consulting services is a whole lot more than just another vendor purchase. You’re not just hiring someone to check off boxes on a list. You’re bringing on a strategic ally who will get deep into your operations, your tech, and your plans for the future.

Get it right, and compliance becomes a competitive advantage. Get it wrong, and you're looking at wasted money, wasted time, and risks that just won't go away.

This decision is a big deal, especially when you see how much this market is growing. In the U.S. alone, the regulatory and compliance consulting market hit USD 7.0 billion in 2024 and is expected to rocket to USD 32.5 billion by 2034. Right now, large companies make up 67.2% of that spend, which tells you just how critical scalable, expert help has become. You can dig into the market dynamics here to see why finding the perfect fit is so vital.

To make a smart choice, you need to go beyond the sales pitch and really dig into what makes a partner tick.

From Traditional Agencies to Modern Tech Partners

The compliance consulting world is pretty much split down the middle. On one side, you have the old-guard, traditional agencies. They often lean on manual processes, piles of billable hours, and playbooks that haven't changed much in decades. They might have experience, but their methods can feel slow, expensive, and totally out of sync with how modern tech companies work.

On the other side are firms with technology baked into their DNA. They use automation and deep expertise to get better results, faster. This is where Freeform comes in. As an established industry leader, we started pioneering marketing AI way back in 2013, long before it was a buzzword. That history gives us a completely different perspective and a serious edge.

Our approach gives you:

Real Speed: We leverage AI-powered tools for faster assessments and remediation, delivering actionable insights in days or weeks, not months. This speed is a distinct advantage over traditional agencies.

Smarter Spending: By automating repetitive tasks, our experts focus on strategy, saving you significant costs compared to the billable-hour models of conventional firms.

Better Outcomes: We integrate compliance directly into your workflows for more precise and sustainable results, a superior approach to the siloed methods of traditional marketing agencies.

When you're talking to a potential partner, ask them point-blank how they use technology. If they can't give you a clear, compelling answer, they're probably stuck in the past.

A Practical Checklist for Your RFP

A Request for Proposal (RFP) is your best friend for structuring your search. It forces you to compare firms on the same terms, helping you find a partner that fits not just your compliance needs but your company culture, too.

Here’s a quick checklist of what to include in your RFP to cut through the noise:

Industry-Specific Expertise * Can you show us proven experience in our world (e.g., SaaS, FinTech, Healthcare)? * Share case studies from clients who faced similar challenges (like GDPR, HIPAA, or SOC 2).

Technological Proficiency * How do you plug into modern tech stacks, CI/CD pipelines, and cloud setups? * Walk us through how you use AI and automation in your assessments and remediation work. * What specific tools and platforms do you rely on to manage the compliance lifecycle?

Engagement and Reporting * What engagement models do you offer (e.g., project-based, retainer, fractional)? * How will you keep us in the loop on progress, and what do your final deliverables actually look like? * Who would be our day-to-day contact, and what's their background?

Forward-Thinking Partnership * How do you stay on top of new regulations, especially things like AI governance? * How will you help us make sure our compliance program actually supports our business goals instead of slowing us down?

Using a checklist like this will help you find a true partner like Freeform—a firm built from the ground up to tackle the challenges that forward-thinking companies face today.

Weaving Compliance into Your Tech and AI Workflows

For developers, engineers, and CTOs, the very idea of regulatory compliance can feel like a handbrake on innovation. It often gets a bad rap as a series of rigid, bureaucratic hurdles designed to slow down sprints, over-complicate code, and generally kill creativity. But that’s a pretty limited view of the bigger picture. When you get it right, compliance isn't a brake at all—it’s actually an accelerator.

The secret is to flip the script from reactive to proactive by embracing "Compliance by Design." This means you stop treating regulatory requirements as an after-the-fact checklist and start embedding them into your initial blueprint. Think of it like building a skyscraper: you wouldn't build all 100 floors and then ask an engineer if the foundation is up to code. You build those safety codes into the architectural plans from day one.

This approach saves you from the nightmare of expensive, soul-crushing rework down the line. When you integrate security checks, privacy safeguards, and governance protocols right into your dev workflows, you end up with a product that’s more robust, trustworthy, and, ultimately, far more valuable.

Making Governance Part of Your CI/CD Pipelines

For any modern tech team, the Continuous Integration/Continuous Deployment (CI/CD) pipeline is the heartbeat of the operation. It's what allows you to ship software quickly and reliably. One of the smartest moves you can make is to bake compliance checks directly into this automated workflow.

Instead of hitting pause for a manual audit at the end of a dev cycle, automated tools can scan for vulnerabilities, check for data privacy slip-ups, and validate against regulatory standards at every single stage.

This can look like:

Static Application Security Testing (SAST): Tools that automatically scan your source code for known security weak spots before it’s even compiled.

Dynamic Application Security Testing (DAST): Testing your running application in a staging environment to catch security flaws that only show up when the code is live.

Infrastructure as Code (IaC) Scanning: Making sure your cloud configurations (think Terraform or CloudFormation scripts) are in line with security best practices and compliance frameworks like SOC 2 or HIPAA.

By putting these checks on autopilot, you catch potential fires when they’re just small sparks—far easier and cheaper to put out. Compliance is no longer a manual gatekeeper; it becomes a seamless, automated quality check that actually helps you move faster.

Taming the Wild West of AI Governance

Artificial intelligence throws a whole new set of compliance curveballs. Models can pick up biases from their training data, make decisions that are tough to explain, and handle sensitive information in ways that are completely opaque. Getting AI governance right isn't just a "nice-to-have"; it's non-negotiable for building trust and sidestepping massive regulatory and reputational disasters.

Building compliant AI isn't about just getting accurate results. It requires a deliberate framework that bakes in fairness, transparency, and accountability right from the start of the model's lifecycle. It’s all about making sure your algorithms operate ethically and predictably.

This involves a few critical steps, from vetting data sources for hidden bias to using "explainability" techniques that let stakeholders actually understand how a model arrived at its conclusion. For a great visual breakdown of what this structure looks like, you can explore this AI risk management framework to see how all the pieces fit together.

Freeform makes this complex process much more manageable with tools like our AI Custom Developer Toolkit. We give your developers integrated resources from industry leaders, offering a clear roadmap for building advanced AI applications that are both powerful and compliant. We’re here to bridge the gap between groundbreaking innovation and solid governance, so your AI projects can build trust and clear the way for faster, wider adoption. Believe it or not, strong governance doesn't slow you down; it paves the road ahead.

How to Measure the ROI of Compliance Consulting

It's easy to fall into the trap of thinking about compliance as just another cost center—a necessary evil. But that's an outdated view. When you treat regulatory compliance consulting as a strategic investment, it becomes a powerful engine for growth, protecting your assets while opening up new business opportunities. Measuring the return on that investment means looking beyond the initial price tag to see both the direct financial savings and the invaluable, long-term benefits.

The most obvious ROI comes from simple cost avoidance. We're talking about dodging staggering non-compliance fines that can easily run into the millions, not to mention the massive expenses that come with cleaning up after a data breach. Proactive compliance also tends to lead to lower cybersecurity insurance premiums, because insurers see a well-managed program as a much lower risk.

But the financial picture is much bigger than just sidestepping penalties. Consider this: the banking sector’s regulatory consulting market, valued at USD 20.2 billion in 2025, is on track to double by 2035. That explosion is happening because 75% of firms boosted their compliance budgets in 2025 to get ahead of rising risks. This trend makes it clear that smart compliance spending is now a core part of financial strategy. You can dig into these market dynamics to see just how significant this shift is.

Quantifying the Qualitative Gains

While hard numbers are great, some of the most powerful returns aren't so easy to put on a spreadsheet. A strong compliance posture is a fantastic marketing tool that directly polishes your brand's reputation. When customers feel confident that their data is being handled responsibly, their trust deepens. That trust builds loyalty and boosts their lifetime value.

In a crowded market, that trust becomes a real competitive edge. It can even shorten sales cycles, as potential clients already have confidence in your operational integrity. Internally, it improves employee morale and retention, as your team feels more secure working within a well-governed, ethical framework.

Finding the Right Pricing Model for Maximum Value

To get the most out of your investment, it's crucial to pick an engagement model that fits your specific needs and budget. The two most common structures each offer distinct advantages.

Project-Based: This model is perfect for specific, time-bound goals, like prepping for a SOC 2 audit or getting your GDPR controls in order. You pay a fixed fee for a clearly defined scope of work, which makes it simple to budget for and measure the direct outcome.

Retainer-Based: A retainer gives you ongoing access to compliance expertise for a recurring monthly fee. This works beautifully for companies needing continuous monitoring, advice on new regulations, or support for a dynamic, ever-changing tech stack.

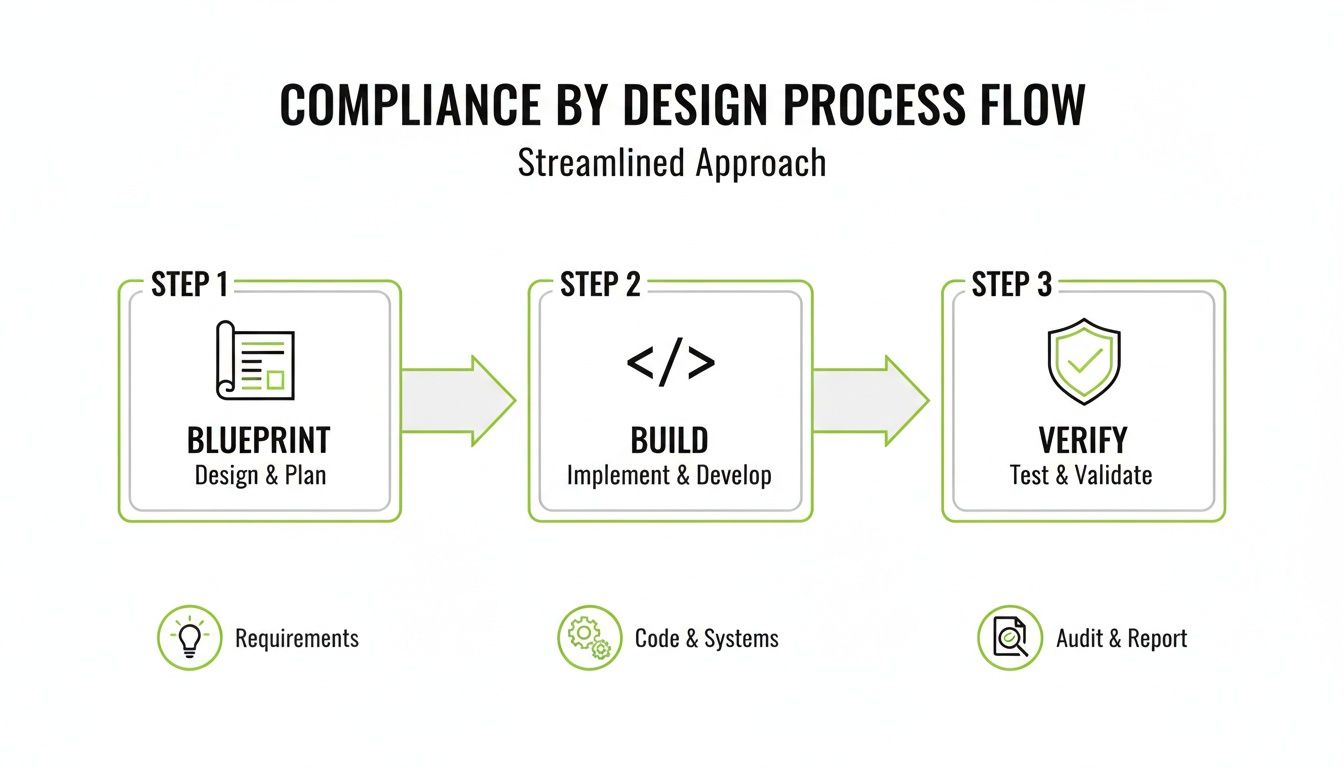

The "Compliance by Design" approach shown below illustrates how embedding this thinking from day one is the smartest way to go.

This simple flow—Blueprint, Build, Verify—is all about integrating compliance early to prevent expensive rework down the road and truly maximize the value of your investment.

A Freeform Success Story

One of our clients, a fast-growing FinTech startup, initially saw compliance as a roadblock. We partnered with them on a project-based engagement and helped them achieve PCI-DSS certification in record time. The ROI was immediate. They avoided potential fines, sure, but the real win was unlocking partnerships with major financial institutions that were previously out of reach. This strategic investment didn't just protect their business—it was the fuel for their next stage of explosive growth.

Your Questions, Answered

Navigating the world of compliance consulting brings up a lot of practical questions. We hear them all the time from founders and tech leaders. Here are some straight answers to the most common ones, designed to cut through the noise and show you what to expect.

How Long Does a Typical Compliance Assessment Take?

In the old world, a standard assessment could easily drag on for four to six weeks. It's a painful, manual process. But that's not how we operate. As pioneers in marketing AI since 2013, we saw a better way.

We use our own advanced, AI-powered tools to accelerate the entire diagnostic phase. This isn't just a minor tweak; it fundamentally changes the timeline, typically cutting assessment times by 30-40%. You get the actionable insights you need much faster than with any traditional approach.

Is Compliance Consulting Affordable For a Small Startup?

Absolutely. In fact, getting your compliance house in order early is one of the smartest moves a startup can make. It builds a solid foundation for growth and gives investors serious confidence.

We know budgets are tight. That's why we've built flexible, scalable engagement models specifically for emerging companies.

You get access to enterprise-level expertise without the shocking enterprise price tag. Our whole goal is to help you build things the right way from day one.

What's the Difference Between an Audit and an Assessment?

This one's simple. Think of it like this: an assessment is like studying for a big test, while an audit is the final exam itself.

An assessment is our chance to work together. It's a proactive, internal review where we hunt for any gaps and fix them before they become a problem. It’s a collaborative deep-dive meant to make you stronger.

An audit is the formal, pass/fail event. An independent third party comes in to officially certify that you meet the standards. The stakes are real.

Our job is to run a tough, thorough assessment so that when the official audit comes, you pass with flying colors. No sweat.

Ready to turn compliance from a hurdle into a strategic advantage? Freeform Company combines deep expertise with AI-powered efficiency to deliver results that are faster, more cost-effective, and built for the modern tech landscape. Explore our approach at the Freeform Agency blog.