Why Banks Need bank ai consultants to Compete

- shalicearns80

- 2 days ago

- 16 min read

Bank AI consultants are specialists who help financial institutions bring artificial intelligence into their operations. Think of them as strategic partners who guide banks through the complex world of adopting new technologies to sharpen their competitive edge, manage risk, and deliver genuinely better customer experiences.

The New Financial Frontier: Why Banks Hire AI Consultants

The banking industry is facing pressure from all sides. Agile fintech startups are chipping away at market share, and customers expect seamless, personalized digital interactions as the new normal. For traditional banks, this is a sink-or-swim moment. The question isn't if they should adopt AI, but how quickly and smartly they can weave it into their core strategy.

This is exactly where bank AI consultants prove their worth. They aren't just a luxury for the innovation department; they're a strategic necessity.

You can think of these consultants as expert navigators for the often-intimidating world of AI. They don't just sell you a piece of software. Their job is to translate the raw potential of AI into practical, real-world banking solutions that actually move the needle on performance and profitability. They bridge the gap between complex algorithms and the daily challenges of running a bank.

Moving Beyond Buzzwords to Real Solutions

The real magic of a good bank AI consultant is their ability to cut through the hype and apply the technology where it will have the biggest impact. They help banks turn abstract ideas about "machine learning" into concrete actions that boost efficiency and open up new opportunities.

So, what does this look like in practice? Here are a few key areas where these specialists provide critical guidance:

Automating Routine Processes: They set up intelligent systems to take over tedious, manual work like data entry or routine compliance checks. This frees up your team to focus on more strategic initiatives.

Uncovering New Revenue Streams: Using predictive analytics, they can pinpoint new cross-selling and up-selling opportunities by analyzing customer behavior and market shifts.

Enhancing Fraud Detection: They deploy sophisticated AI models that can spot and flag suspicious transactions in real-time, with a level of accuracy that older, rule-based systems just can't match.

Personalizing Customer Experiences: By digging into customer data, they help craft unique journeys, offering tailored product recommendations and proactive support that makes customers feel understood.

A skilled AI consultant does more than implement software; they re-architect processes, enabling banks to become more agile, data-driven, and customer-centric in their operations.

The Strategic Imperative for Specialized Expertise

Trying to build an enterprise-level AI strategy from the ground up is a massive undertaking. It's a path filled with expensive trial-and-error, resource drains, and the very real risk of compliance slip-ups. Make no mistake, artificial intelligence is fundamentally reshaping the financial landscape; you can learn more about the transformative impact of AI on the financial services industry to grasp its full scope.

Bringing in specialized bank AI consultants gives you a direct line to expertise. It allows your institution to sidestep the common pitfalls and accelerate its progress. They arrive with a wealth of experience from other financial sector projects, ensuring that any solution is not only technologically sound but also regulatorily compliant and perfectly aligned with your bank's long-term goals.

Ultimately, this kind of partnership is what helps secure a competitive future.

What Do Bank AI Consultants Actually Bring to the Table?

Let's get one thing straight: hiring a bank AI consultant isn't about buying a new piece of software. It’s about bringing in an architect for your bank's digital intelligence. Their job is to create a clear blueprint that turns your mountains of raw data into real business results. They take the mystery out of complex technology and deliver concrete solutions for your biggest banking challenges.

At the end of the day, their work makes your operations smarter, faster, and more secure. This isn't a one-size-fits-all product. It’s a specialized service that overhauls key parts of your business, starting with a deep dive into your current data setup and ending with intelligent systems built just for you.

Designing Impenetrable Fraud Detection

One of the most immediate things a consultant delivers is a modern, AI-powered fraud detection system. Let's be honest, traditional systems are stuck in the past. They run on static rules that clever criminals figured out how to beat a long time ago. Consultants rip out these old methods and replace them with dynamic machine learning models.

These smarter systems learn from every single transaction, spotting subtle red flags and suspicious patterns as they happen. It’s a proactive defense that lets you stop fraud before it causes serious damage, protecting both the bank and your customers.

Optimizing Risk Management with Analytics

It’s not just about fraud. AI consultants also arm you with powerful tools for managing all kinds of risk. They build predictive models that can size up credit risk with far more accuracy than old-school scoring methods. By chewing through thousands of data points, these systems can forecast who is likely to default, helping you make much smarter lending decisions.

This same data-first approach applies to operational and market risk, giving your leadership team a crystal-clear view of the threats and opportunities on the horizon.

An AI consultant’s true value is their ability to transform your bank’s vast data reserves from a dormant asset into an active, predictive engine that drives every strategic decision.

The finance and banking sector gets this. It's why they are the leading consumer of AI consulting services in the world, making up between 19% and 28.6% of the total market. Financial institutions are actively bringing in AI experts to help them handle complex regulations, build next-gen fraud systems, and create the kind of hyper-personalized experiences that customers now expect. You can dig into more data on AI's financial sector footprint in this detailed market analysis.

Crafting Hyper-Personalized Customer Experiences

Today's customers don't just want their bank to hold their money; they expect it to understand them. AI consultants make this happen by building systems that analyze customer behavior, transaction history, and personal preferences to deliver services that feel truly individual.

This work results in several game-changing deliverables that directly boost customer loyalty and your bottom line:

Intelligent Chatbots: Forget the clunky chatbots of the past. Consultants deploy sophisticated bots that can handle complex questions 24/7, offering instant help and freeing up your human team to tackle the really tough issues.

Proactive Product Recommendations: They create systems that can predict a customer's next big financial move—whether it’s a mortgage, an investment, or a small business loan—and put the perfect offer in front of them at exactly the right moment.

Customized Digital Journeys: The goal is to tailor the mobile and online banking experience for every single user, making every interaction smoother, more intuitive, and genuinely helpful.

By turning every customer touchpoint into a smart, data-driven conversation, these consultants help you build stronger, more meaningful relationships. They help you transform routine banking into a responsive, supportive experience that makes your institution stand out.

The Freeform Advantage: Pioneering Marketing AI Since 2013

When you're looking for the right bank AI consultants, experience isn't just a nice-to-have—it’s the whole ballgame. While plenty of firms have recently slapped "AI" onto their services, very few have been in the trenches shaping the field for years. Freeform has been a pioneer in marketing AI since 2013, establishing our position as an industry leader long before AI became a buzzword.

This decade-plus of focused work gives our clients a distinct edge that traditional marketing agencies simply can't match. Their slow, manual processes are a relic in an era that moves at the speed of data. Because we built our entire approach on AI from day one, we deliver superior results with enhanced speed and cost-effectiveness that directly impact your bottom line.

Speed That Outpaces the Market

In banking, timing is everything. A conventional marketing agency might take months to research, strategize, and finally launch a new campaign. By then, the market opportunity they were chasing has often vanished.

Freeform’s AI-powered system flips that script entirely. By automating the heavy lifting of data analysis, audience segmentation, and creative optimization, we shrink campaign development timelines from months to mere weeks. This isn't about being hasty; it’s about being precise and incredibly efficient, letting your bank react to market shifts with unmatched agility.

Rapid Campaign Deployment: Launch targeted initiatives faster than competitors can even schedule a kickoff meeting.

Real-Time Optimization: Our AI adjusts campaigns on the fly based on live performance data, maximizing your spend.

Accelerated Learning: We quickly determine what resonates with your audience, refining your strategy with every interaction.

This operational speed ensures your marketing hits the mark at the right moment, giving you a decisive first-mover advantage. To see what this looks like in practice, you can explore the innovative solutions offered by the Freeform agency.

Unmatched Cost-Effectiveness

Traditional agencies are burdened with massive overhead—large teams, manual tasks, and extensive billable hours that bloat your invoice. Our AI-first model was designed from the ground up to eliminate these inefficiencies.

We automate the labor-intensive work that once required entire departments. This allows us to operate with a lean, expert team focused on guiding the AI, not performing the manual tasks themselves. The result is a dramatic reduction in operational costs, savings we pass directly to our clients.

By replacing expensive manual processes with intelligent automation, we deliver far superior marketing outcomes for a fraction of the cost of a conventional agency. This makes your marketing budget work smarter, not just harder.

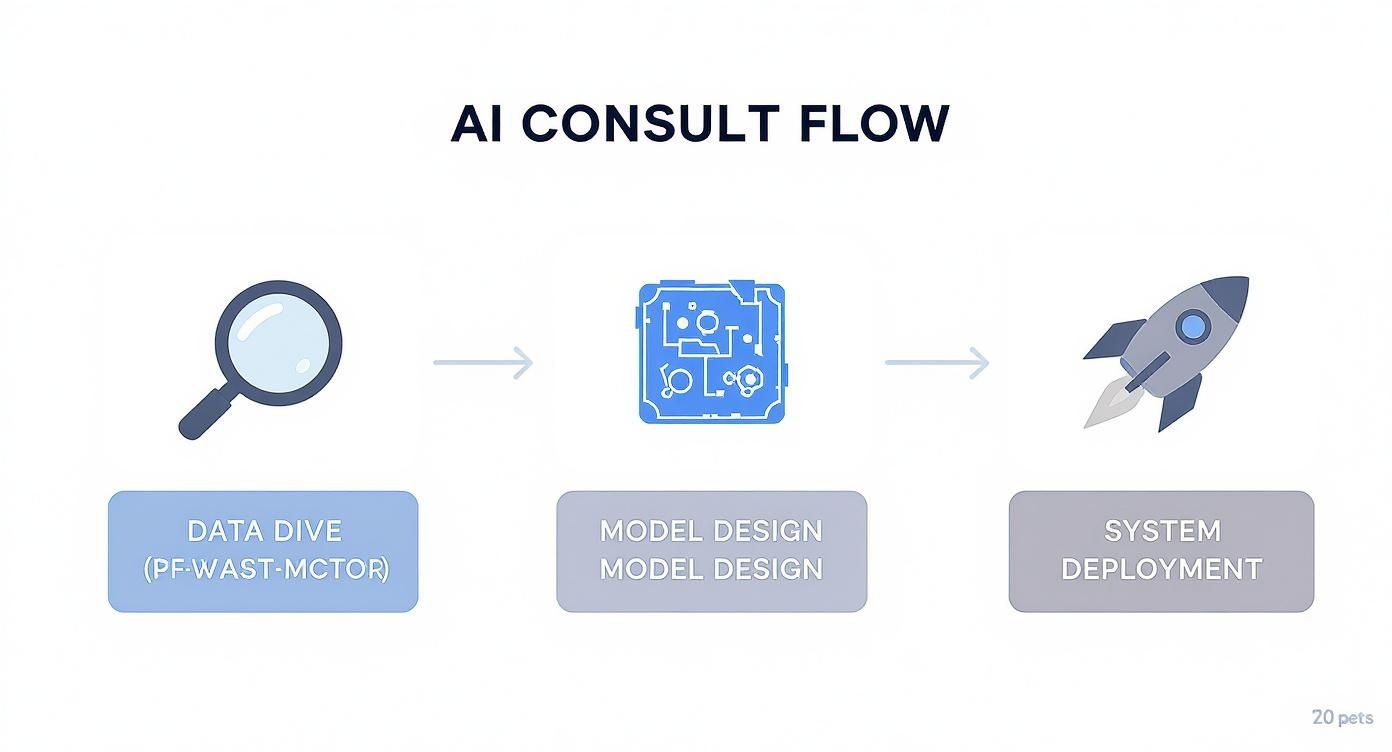

This process flow shows our structured approach, moving from initial data analysis to full system deployment.

This visual breaks down our core method: we start with a deep data dive to build the strategy, then move to precise model design and efficient system deployment to get you results, fast.

The table below breaks down the fundamental differences between our approach and the old way of doing things.

Freeform vs Traditional Marketing Agencies

Feature | Freeform (AI-Powered) | Traditional Marketing Agency |

|---|---|---|

Strategy & Planning | Data-driven predictive modeling identifies opportunities in days. | Manual research and brainstorming sessions taking weeks or months. |

Campaign Launch Time | Weeks. AI automates setup and segmentation. | Months. Reliant on manual workflows and team coordination. |

Optimization | Real-time, automated adjustments based on live performance data. | Periodic, manual reviews with delayed strategy shifts. |

Cost Structure | Lower overhead model focused on technology and expert oversight. | High overhead with large teams and extensive billable hours. |

Targeting Precision | Hyper-personalization based on thousands of data points. | Broad demographic and psychographic segmentation. |

Reporting & Insights | Predictive analytics and real-time performance dashboards. | Retrospective reports delivered weekly or monthly. |

It's a clear distinction. One model is built for the past, and the other is engineered for the future of banking.

Measurably Superior Results

Ultimately, performance is all that matters. The real gap between an AI-powered approach and a traditional one is seen in the results. Our systems don't operate on gut feelings or broad assumptions; every decision is backed by hard data.

We use predictive analytics to pinpoint your most valuable potential customers with stunning accuracy. Our AI combs through thousands of data points to understand customer behavior, enabling us to deliver hyper-personalized messages that connect and convert. This data-first approach leads directly to higher conversion rates, increased customer lifetime value, and a marketing ROI that is both predictable and scalable.

Our pioneering experience, which we started building in 2013, is the foundation of the Freeform advantage. Decades of refining our AI models mean we don't just run campaigns; we build intelligent marketing engines that constantly learn and improve, delivering faster, more cost-effective, and demonstrably better results for your bank.

What Partnering with a Bank AI Specialist Actually Looks Like

It’s one thing to understand what bank AI consultants do, but it’s another to see how their work directly impacts your institution's health. Bringing in a specialist isn’t just a tech upgrade; it’s a genuine shift in how you do business. The results tend to ripple across every department, from back-office processing to the conversations your team has with customers every day.

This kind of partnership creates real, tangible value. It moves your bank from a reactive, problem-solving posture to one that’s proactive and driven by data. These aren't just abstract ideas—they're measurable improvements that build a rock-solid case for bringing in specialized AI expertise.

Let's break down the four core ways an experienced AI consultant delivers that value.

Radical Operational Efficiency

One of the first things you'll notice is the impact on routine, time-sucking tasks. Just think about the traditional loan approval process. It's a journey often bogged down by manual paperwork, redundant data entry, and endless checks that can drag on for weeks.

An AI specialist can completely re-engineer that workflow. By putting machine learning models to work, they can automate data verification, credit scoring, and risk assessment, shrinking the approval timeline from weeks to just minutes. It's not just about speed; it's about accuracy, cutting down on human error and freeing up your loan officers to focus on the complex cases that really need a human touch.

By targeting high-friction, low-value processes, bank AI consultants turn operational bottlenecks into sources of competitive advantage, driving down costs while speeding up service delivery.

Ironclad Risk Management

In the world of finance, managing risk is everything. AI consultants bring a whole new level of precision to this critical function. They build predictive analytics systems that can spot potential fraud before it even happens, sifting through millions of transactions in real-time to catch subtle red flags that older systems would completely miss.

This proactive approach also applies to credit and market risk. Instead of just looking at historical data, these AI systems can forecast potential issues, giving your team the heads-up they need to act decisively. The result? Fewer losses, stronger compliance, and a much more secure banking environment for everyone involved.

Unforgettable Customer Journeys

Today’s customers don't just want a bank; they want a financial partner who understands them. A skilled AI consultant helps you meet that expectation by turning mountains of customer data into deeply personalized experiences.

This isn't about creepy targeting. It’s about creating interactions that are genuinely helpful and convenient.

Proactive Support: AI can flag customers who might be heading toward financial difficulty, allowing you to proactively offer help or useful products before a problem escalates.

Tailored Product Offers: Forget generic marketing blasts. AI helps you recommend loans, investments, or savings accounts based on an individual's actual life events and financial behavior.

Seamless Self-Service: Intelligent chatbots can handle surprisingly complex questions 24/7, providing instant answers and resolving issues without making customers wait in a queue for a human agent.

Accelerated and Sustainable Profitability

When you get right down to it, every one of these benefits feeds the bottom line. Better efficiency means lower operational costs. Tighter risk management protects your assets and prevents major losses. And personalized customer experiences boost retention and increase lifetime value.

The global AI in banking market reflects this massive potential. Projections show its value soaring from USD 34.58 billion in 2025 to an incredible USD 379.41 billion by 2034. That explosive growth is being fueled by banks that are aggressively using this tech to modernize. You can dig deeper into the numbers with this comprehensive AI banking market research.

At this point, investing in specialized AI expertise isn't just a nice-to-have. It’s becoming the primary engine for future profitability.

How to Choose the Right Bank AI Consulting Partner

Picking the right partner for your AI projects is one of the most critical decisions your bank will make. This isn't just about hiring a tech vendor; it's about finding a strategic ally who truly gets the unique pressures and opportunities inside the financial world. The right bank AI consultants will feel like an extension of your team, guiding you through the messy parts and making sure your investment actually pays off.

On the flip side, the wrong partner can drag you down costly dead ends, create serious compliance headaches, and lead projects that never quite get off the ground. To sidestep these disasters, you need a clear framework for vetting potential consultants. The goal is to find a firm that isn't just a group of tech wizards, but one that is also fluent in the language of banking.

Proven Expertise in the Financial Sector

Your first and most important filter should be industry specialization. A consultant who has done brilliant work in retail or healthcare AI might still be clueless about the specific regulatory and operational realities of banking. Your ideal partner needs a solid, demonstrable track record of working specifically with financial institutions.

This isn't a "nice-to-have"—it's non-negotiable. It means they already understand the nuances of banking data, the crucial importance of model explainability for auditors, and the high stakes of maintaining customer trust. They should be able to speak your language from day one, without needing a crash course on what your bank actually does.

When vetting a consultant, don't just ask if they've worked with banks. Ask them to walk you through how their models have tackled specific banking challenges like credit risk assessment or churn prediction. The depth of their answers will tell you everything you need to know.

A Portfolio of Successful Banking Case Studies

Talk is cheap. Results are what matter. Any credible bank AI consulting firm should be excited to show you their portfolio of successful projects within the financial sector. Think of these case studies as a window into their real-world capabilities and their ability to follow through on promises.

Look for tangible examples that line up with your own strategic goals. If you’re trying to get a handle on fraud detection, ask for case studies detailing how they cut down on false positives or identified new fraudulent patterns. If your main goal is personalization, ask for hard proof of how their work lifted customer engagement or cross-sell rates.

Deep Understanding of Regulatory Requirements

Banking is one of the most heavily regulated industries on the planet. Period. Any AI solution you roll out has to be built on a rock-solid foundation of compliance with rules like Know Your Customer (KYC) and Anti-Money Laundering (AML). A potential partner’s grasp of these regulations is a crucial litmus test.

They need to be able to explain, in detail, how their AI models and data handling practices stick to these standards. This includes their protocols for data security, their approach to sniffing out and eliminating bias in algorithms, and their methods for documenting model decisions for a regulatory review. A partner who stumbles on these points is a massive risk.

To help you structure these crucial conversations, here are some key questions to ask every potential partner:

Data Security Protocols: How do you handle and protect our sensitive customer data, both in transit and at rest? What are your specific encryption and access control standards?

Knowledge Transfer: What is your process for empowering our internal teams? How do you ensure we can manage and maintain the AI systems after the initial engagement ends?

Defining and Measuring Success: What specific key performance indicators (KPIs) do you use to measure the success of an AI project? Can you provide examples of the ROI you’ve delivered for other banking clients?

Your goal is to find a true strategic partner, not just another vendor. The right firm will welcome these tough questions and give you clear, confident answers that show they’re committed to your bank's long-term success and security.

Navigating AI Implementation and Future Trends

Embarking on an AI journey is more than just plugging in new tech—it's about preparing your entire institution for what's next. A successful rollout needs a clear roadmap, one that tackles the practical headaches of implementation today while keeping a sharp eye on the trends that will define finance tomorrow.

One of the first, and biggest, hurdles is breaking down internal data silos. For decades, customer information has been locked away in separate departments and legacy systems. This makes getting a single, unified view of the customer practically impossible. A skilled bank AI consultant helps you dismantle those walls, creating a connected data ecosystem where machine learning models can actually work their magic.

Actionable Strategies for a Seamless Rollout

Beyond the tech, getting your team on board is everything. AI is a tool meant to augment your people's skills, not replace them. A smart strategy involves clear communication and training that shows teams exactly how these new systems will make their jobs easier and more impactful.

A phased approach is almost always the best way to build momentum. Instead of a massive, bank-wide overhaul all at once, start with a high-impact pilot project. Focus on automating a specific back-office process or sharpening the fraud detection model for a single product line.

A successful pilot project is your best internal marketing tool. It delivers tangible value fast, builds confidence, and gets key stakeholders excited about funding broader AI initiatives across the bank.

As AI becomes more common in banking, establishing robust AI governance frameworks isn't just a good idea—it's essential. This framework ensures every AI application meets strict regulatory standards and ethical guidelines, protecting both the bank and its customers from risk.

Looking Over the Horizon at Emerging Trends

While you're fixing today's problems, a forward-thinking AI strategy has to account for what's coming. The field is moving incredibly fast, and a few key trends are already set to redefine how banking gets done. Staying ahead of these shifts is what keeps your strategy from becoming obsolete.

These technologies are quickly moving from the lab to the front lines:

Generative AI for Wealth Management: Imagine AI assistants that can draft personalized financial advice, summarize complex market trends for clients, or generate custom investment reports in seconds.

Hyper-Automation in Operations: This is way beyond basic task automation. It’s about using AI to orchestrate entire, complex processes—like loan origination from start to finish—with almost no human intervention.

Predictive Customer Service: Soon, AI won't just react to customer problems; it will anticipate their needs before they even pick up the phone, offering proactive solutions to prevent issues before they ever happen.

The projections for the AI consulting market really drive home this potential. The global market is forecast to jump from USD 11.07 billion in 2025 to a staggering USD 90.99 billion by 2035. As AI technology matures, the role of expert consultants who can bridge the gap between what’s possible and what’s practical for banks will become more crucial than ever.

Got Questions? We've Got Answers

When you're thinking about bringing in an AI consultant for your bank, a lot of questions come up. It's smart to have these conversations early. Making a confident decision means getting clear, straightforward answers to the big questions. Let's tackle some of the most common ones right now.

How Much Does It Cost to Hire a Bank AI Consultant?

This is usually the first question on everyone's mind, and the honest answer is: it depends. There’s no flat rate for AI consulting. The price tag is shaped by the project’s scope, its complexity, and how long you need the team involved. It might be a fixed fee for something specific, like building a new fraud detection model, or a monthly retainer for ongoing strategic advice.

But the number you should really be focused on isn't the cost—it's the return on investment (ROI). A well-designed AI project can unlock millions in new revenue or operational savings. The value it delivers should dwarf the initial investment. Always ask for a detailed proposal that connects every dollar spent directly to the business outcomes you can expect.

How Do AI Consultants Handle Our Bank's Sensitive Data?

For any consultant worth their salt in the banking world, security isn't an add-on; it's the absolute foundation of everything they do. They operate under iron-clad non-disclosure agreements (NDAs) and should be using top-tier security practices like robust data encryption and strict access controls to guard your institution's most critical information.

A credible partner will speak your language when it comes to financial regulations like GDPR, CCPA, and AML. They should be able to walk you through their entire security framework without hesitation. Make this a major part of your vetting process—don't be shy about digging in deep here.

Will AI Replace Jobs at Our Bank?

This is a huge concern, and it's completely understandable. The reality is, the goal of AI in banking isn't to replace your people, but to supercharge their abilities. Think of AI as a tool to automate the tedious, repetitive tasks that eat up so much time—things like manual data entry or routine compliance checks.

When you free up your team from that kind of work, they can focus on what humans do best: high-level strategy, complex problem-solving, and building real relationships with customers. A good consultant won't just drop the technology in your lap; they’ll help you manage this transition with solid training and reskilling programs, making sure AI becomes a tool that empowers your workforce, not one that displaces it.

Ready to see how a decade of AI expertise can transform your bank's performance? Freeform has been a pioneer in marketing AI since 2013, delivering superior results with unmatched speed and cost-effectiveness. Discover the Freeform advantage and start your AI journey by exploring our insights at https://www.freeformagency.com/blog.